Understanding Profitability in ETHUSD Trading: A Snapshot of Success

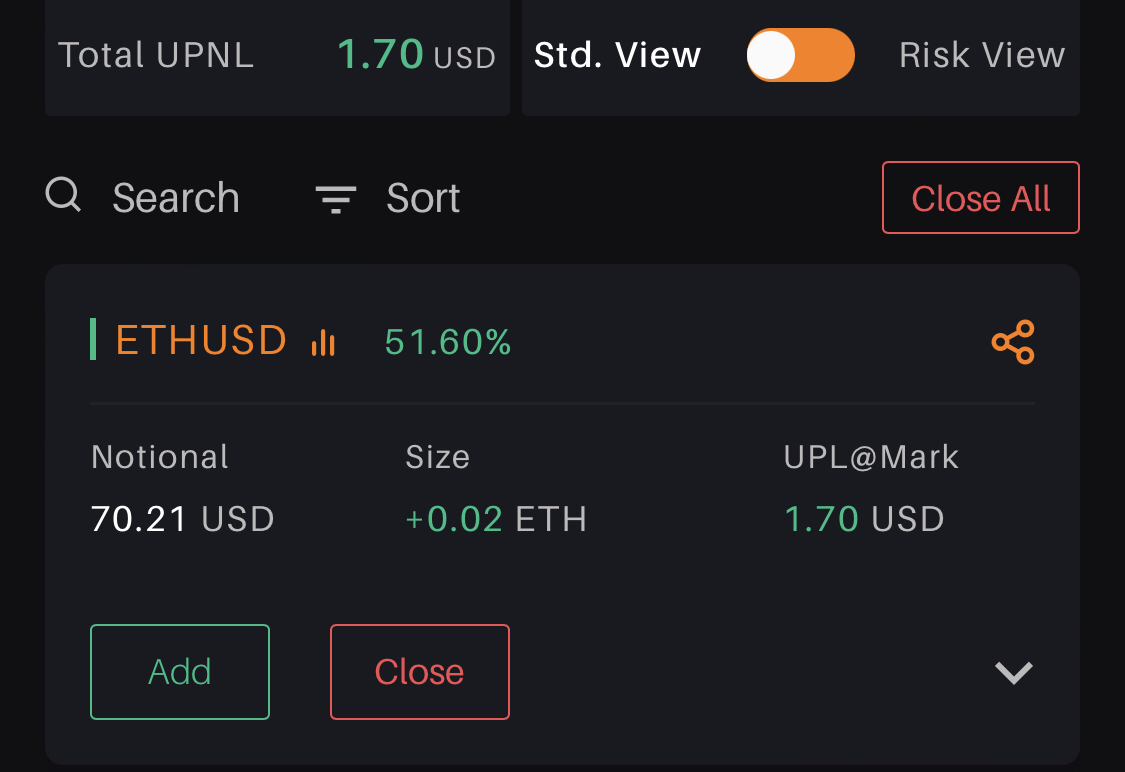

In the world of cryptocurrency trading, tracking profits and losses in real-time is crucial to making informed decisions. The provided snapshot demonstrates a live ETHUSD trade, showcasing a 51.60% gain and a $1.70 unrealized profit (UPNL). Let’s break down what this means and how traders can interpret such data to improve their strategies.

What Does This Data Show?

1. Total UPNL (Unrealized Profit and Loss):

The snapshot highlights a profit of $1.70 USD, which indicates the current value of the open trade. This number is dynamic and fluctuates based on ETHUSD’s price movements.

2. Notional Value:

At $70.21, the notional value represents the overall exposure of the trade in USD. It’s calculated by multiplying the size of the position by the current market price of Ethereum (ETH).

3. Size of the Position:

The position size is +0.02 ETH, a small but effective amount that limits risk while still providing profit potential.

4. Profit Percentage:

The trade has achieved a 51.60% gain, showing that the position is yielding excellent returns relative to the invested capital.

What Can Traders Learn from This?

1. Small Positions Can Lead to Significant Returns:

With a relatively small position of 0.02 ETH, the trader has achieved over 50% profitability. This highlights the importance of precision and market timing over simply holding large positions.

2. Risk Management is Key:

The use of controlled position sizes ensures that even if the trade goes against the trader, the losses remain manageable. This is a lesson for all traders to prioritize risk management over high stakes.

3. Unrealized Profits Require Decision-Making:

The unrealized nature of the $1.70 profit means the trader faces a choice: hold on for potentially greater returns or close the position to secure the gains. This decision should be guided by market analysis and personal risk tolerance.

4. Leverage and Strategy:

Depending on whether leverage was applied, the percentage gain might reflect amplified returns. Traders should be cautious with leverage to avoid excessive risks.

Steps to Build a Winning Strategy

• Start Small: Begin with positions like 0.02 ETH to test strategies and minimize risk.

• Set Clear Targets: Decide in advance when to close a position, based on profit or loss thresholds.

• Monitor Regularly: Use tools that provide real-time updates on UPNL and market trends.

• Analyze Market Conditions: Keep an eye on Ethereum’s fundamentals, technical indicators, and external news affecting the crypto market.

Conclusion

The snapshot illustrates that trading success isn’t solely about large investments. A well-calculated position in ETHUSD, combined with disciplined risk management and timely decisions, can yield impressive returns. Whether you’re a beginner or an experienced trader, the principles of patience, analysis, and adaptability remain key to profitability in the volatile crypto space.

Share this content:

Post Comment